Welcome back to Decouple, the best source for cutting-edge analysis on nuclear energy, with weekly interviews by Chris Keefer. Watch on YouTube, Spotify, or Apple.

This week, Mark Nelson joins us to deliver his second annual “State of the Atom” address. The nuclear power landscape has transformed in the last two years. Russia continues its nuclear export dominance while the West at last awakens from its stupor, driven by an unexpected force: artificial intelligence's insatiable appetite for baseload power. From Amazon's billion-dollar Susquehanna deal to Three Mile Island's resurrection, Big Tech is discovering what nuclear advocates have long known: that when you need reliable electricity around the clock, few other generation sources compare. Nelson maps the new nuclear battlefield where Chinese reactors scale up to 1,700 megawatts, European phase-outs crumble, and Western teams scramble to assemble the talent and capital needed to compete.

Watch now on YouTube.

We Talk About

The geopolitical restructuring of Western nuclear vendors with Korea-Westinghouse cooperation

Russia's continued dominance in nuclear exports despite international isolation

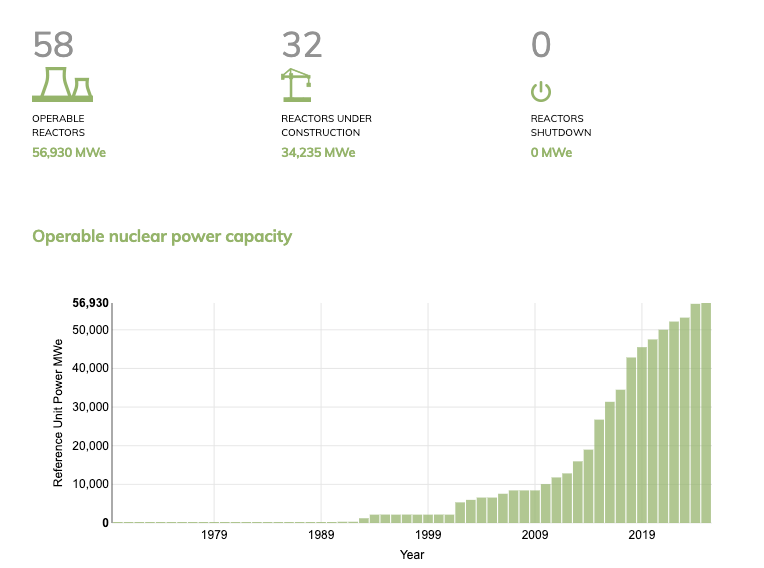

China's nuclear expansion and development of massive 1,700 MW reactors

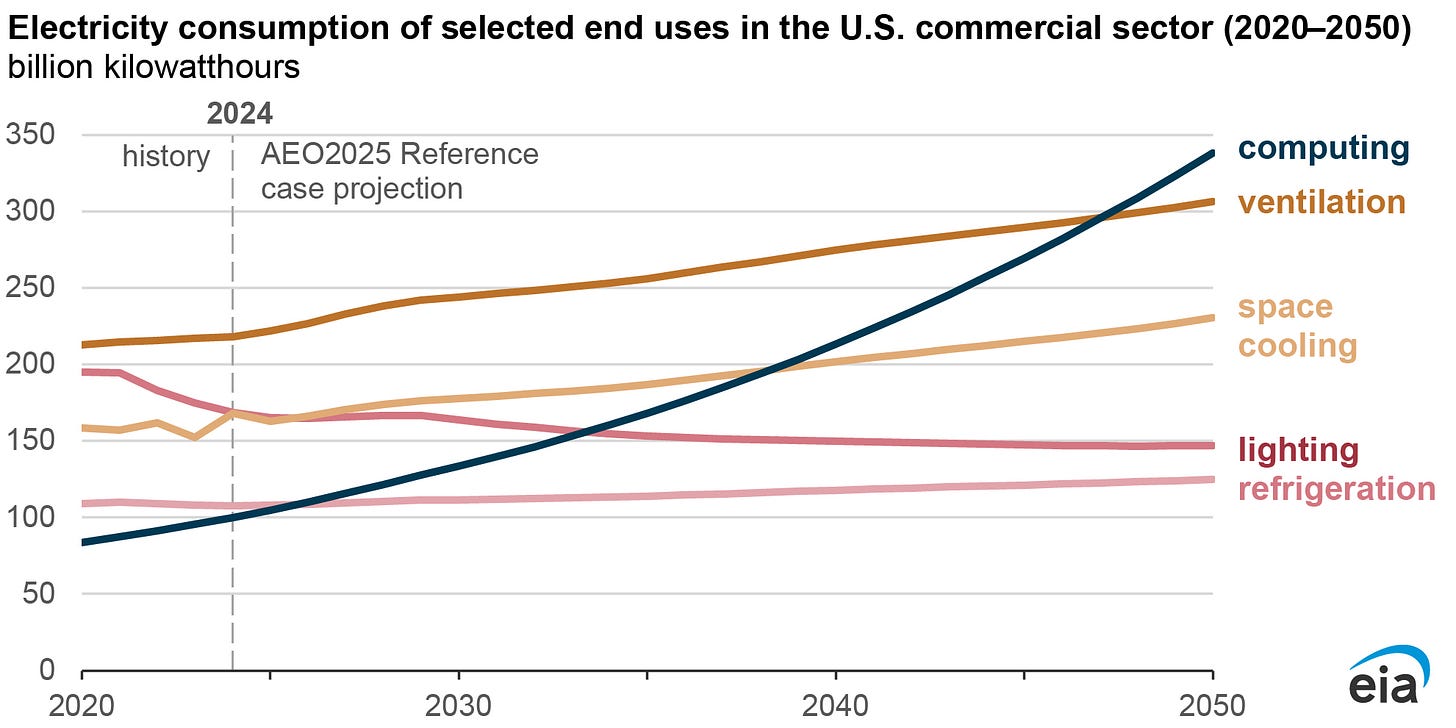

Big Tech's pivot to nuclear: Amazon, Microsoft, and Meta's multi-billion dollar deals

The concept of “additionality” in nuclear power purchasing

Three Mile Island's restart and the economics of nuclear revival

France's nuclear renaissance and the end of European phase-outs

The role of floating nuclear power and Russian Arctic expansion

Nuclear stock market volatility and investment mania

Trump administration's nuclear executive orders and regulatory battles

The future of VC Summer and Western nuclear super teams

Nuclear's role in AI and data center power demands

Deeper Dive

Playing nuclear catch-up

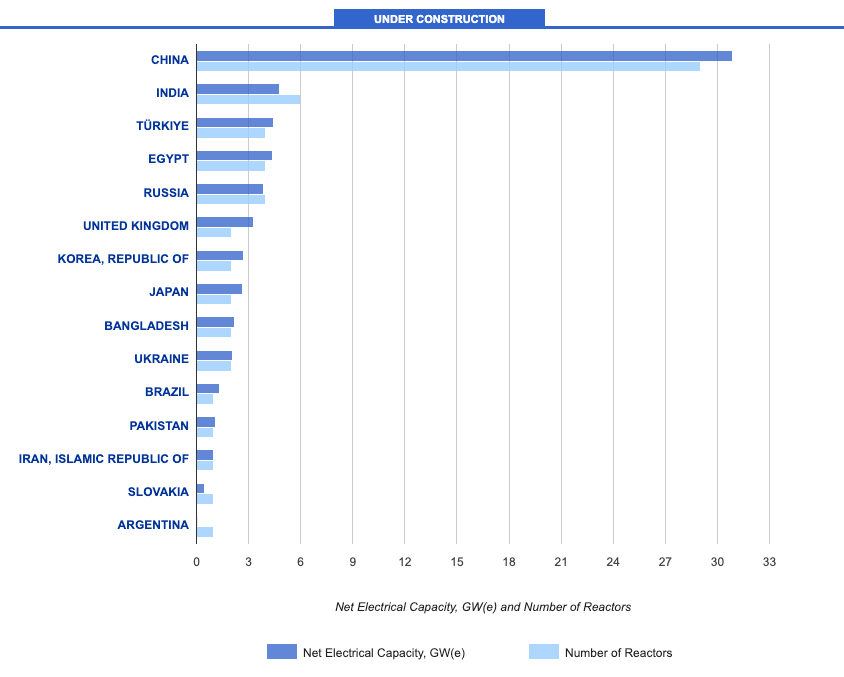

While Western nuclear advocates spent years debating the merits of small modular reactors, Russia and China were busy building real nuclear plants. Today, Russia is proceeding nearly on schedule with all its major international builds while maintaining domestic construction. Meanwhile, China is deploying reactors at roughly $3 billion per gigawatt. In contrast, the latest price estimate of Hinkley Point C in Britain has hit $19 billion per reactor, a monument to how far Western nuclear has drifted from its former level of competence. Where China completes nuclear projects in five to six years, Western timelines stretch to decades. Where Russian icebreaker reactors power Arctic expansion, Western nations debate whether small reactors qualify as “advanced.”

“As the gun went off, the West didn't even know where their running shoes were. That was the start of the AI energy race.” — Mark Nelson

Big tech’s baseload epiphany

In the last two years, the most profound shift in Western nuclear wasn’t technological but commercial. Amazon's near-billion-dollar deal at Susquehanna Steam Electric Station marked the moment big tech seemed to discover clean, baseload power. For years, Mark claims, tech companies funded anti-nuclear climate groups while portraying themselves as being “at war” with industrial electricity. Then artificial intelligence arrived, demanding electricity in undeniably industrial amounts.

Microsoft's Three Mile Island deal epitomizes what Nelson calls “additionality laundry”—paying premium prices to restart shuttered plants that shouldn’t have closed in the first place, and claiming credit for “adding” nuclear capacity. At $115 per megawatt hour for 15 years, Microsoft will fund nuclear revival while maintaining its climate credentials. Meta's 20-year Clinton Nuclear Plant purchase follows the same pattern: tech giants belatedly recognizing that their digital empires rest on industrial electricity.

Phaseout phaseouts

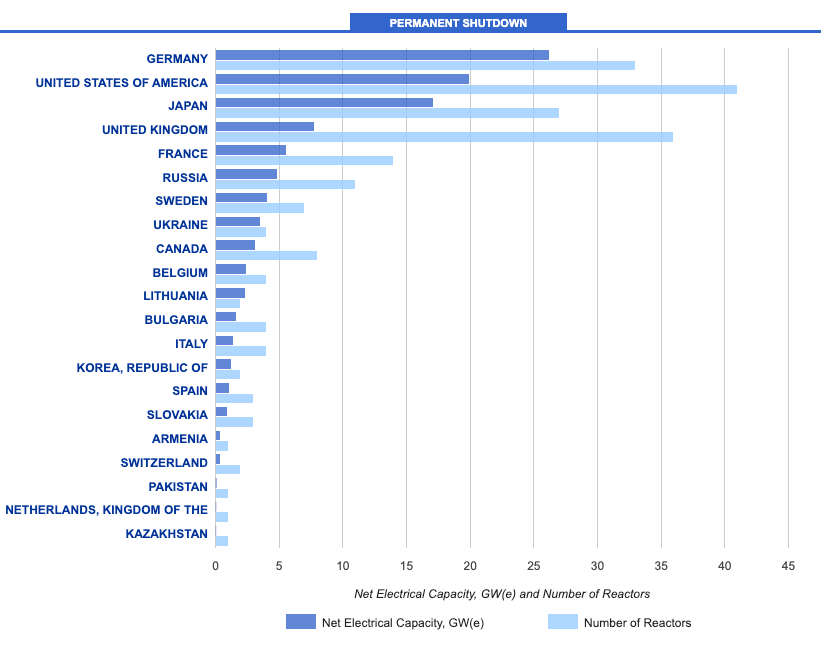

France's parliamentary repeal of its partial nuclear phase-out last year marked the end of an era. Belgium followed suit, officially abandoning its nuclear closure timeline. These reversals signal something deeper than policy changes—they represent the collapse of anti-nuclear orthodoxy that dominated Western energy thinking for two decades.

The transformation is remarkable. Macron, who once promised to dismantle nuclear plants to prove his environmental bona fides, now positions France as Europe's nuclear leader. Germany's unanimous blocking power over international nuclear financing has crumbled. Even Taiwan, having completed its nuclear phase-out, faces growing pressure to reverse course as energy security concerns mount.

China’s scaling revolution

China's development of 1,700-megawatt reactors threatens to make the technology gap unbridgeable. If Chinese manufacturers can mass-produce these giants at their demonstrated $3 billion per gigawatt cost, it becomes almost purely “a political decision,” with little commercial justification, for countries to choose Western alternatives at triple the price.

The implications extend beyond economics. China's conservative approach—limiting inland nuclear plants and maintaining coastal deployments—suggests enormous untapped potential. Nelson notes that China’s current pace of nuclear construction, while impressive, remains “an order of magnitude slower,” on a per-capita basis, than what France achieved during its nuclear buildout. It should be noted that China’s population now is nearly 30 times larger than that of France in the 1970s, meaning such per-capita comparisons tell far from the full story.

Western super teams?

To Nelson, Western nuclear revival depends on assembling what he calls “super teams”—coalitions combining technology owners, experienced operators, patient capital, and desperate customers. The VC Summer decision later this year will likely catalyze one such team around Westinghouse AP1000 technology.

These teams must navigate a landscape where existing nuclear plants trade at premium prices while new construction costs remain punitive. Nelson says the solution may lie in long-term contracts that provide certainty for massive capital investments. Tech companies have demonstrated willingness to pay $90-120 per megawatt hour for 15-20 year deals—prices that could justify new construction if costs can be controlled.

The 2025 State of the Atom reveals an industry at an inflection point. The West's nuclear hibernation is ending, driven not by environmental awakening but by commercial necessity. Whether Western teams can assemble fast enough to compete with Russian exports and Chinese scaling remains the defining question. The next State of the Atom may reveal whether we caught up or fell further behind.

Support Decouple

As big tech scrambles for baseload power, understanding nuclear’s future has never been more crucial. Consider supporting Decouple Media’s commitment to clear-eyed nuclear analysis by pledging on Substack or making a tax-deductible donation through our fiscal sponsor.

Keywords

Nuclear power, artificial intelligence, baseload power, data centers, Russia nuclear exports, China nuclear expansion, Three Mile Island, additionality, nuclear phase-outs, floating nuclear plants, nuclear super teams, VC Summer

Share this post