This week, I’m joined by Kyle Chan to contrast the Chinese and American economic paradigms. Exploring the intense competitive pressures of Chinese “involution capitalism,” in contrast to America’s fixation on shareholder returns, we discuss America’s waning relevance in global technology and manufacturing, and how critical choices made now could shape the economic and geopolitical landscape for decades.

Chan is a postdoctoral researcher at Princeton University, an adjunct researcher at the RAND Corporation, and the author of High Capacity. His op-ed, “In the Future, China Will Be Dominant. The U.S. Will Be Irrelevant,” was recently published in The New York Times and grounds our discussion.

Watch now on YouTube.

We talk about

"Involution capitalism" versus “stock buyback capitalism”

How China's aggressive approach has driven down prices in the solar and battery industries

The long-term consequences of underinvestment in American manufacturing

America’s demographic and geographic advantages vs. China’s state-driven economic coordination

Potential responses from the US government to Chinese industrial strategy

Cultural differences in approaches to governance and capitalism

Risks and opportunities in critical technologies like AI, batteries, and robotics

Deeper Dive

Chinese capitalism seems to court “involution,” or an atmosphere of intense competition within industries toward razor-thin margins. As East Asia researcher Lance Gore puts it:

Involution has become a popular term in China in recent years, describing a range of negative realities: declining quality, efficiency and prices resulting from widespread vicious competition; a lack of prospects; and “meaningless efforts”, such as working excessively long hours for minimal wages.

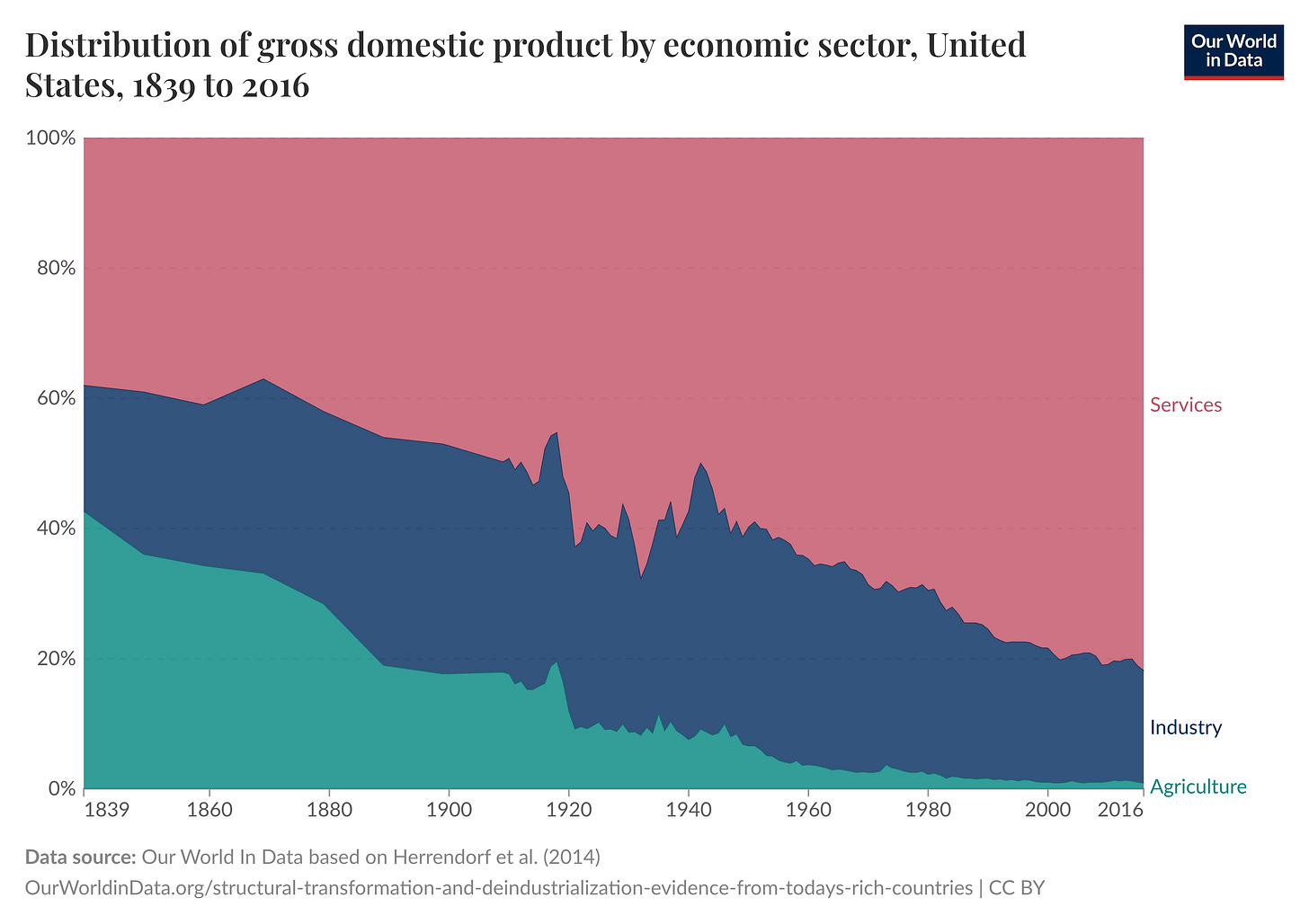

Kyle Chan describes how this atmosphere of involution, despite the dangers of causing industry burnout, creates a potent cycle of innovation, cost reductions, risk-taking among entrepreneurs, and ultimately growth. Above all, it is led by strong industrial policy on the part of the government. By contrast, America remains trapped in a cycle of wavering or non-existent industrial policy and financialization, with a short-term focus on shareholder gains that undermine long-term industrial strength. It is unclear how America could reform its economy to match China’s involution-led productivity and growing dominance across a range of sectors and technologies, even with an attempt to bring manufacturing back to America.

“America might feel secure being number one, but when you zoom in, you see what we actually produce is diminishing.” – Kyle Chan

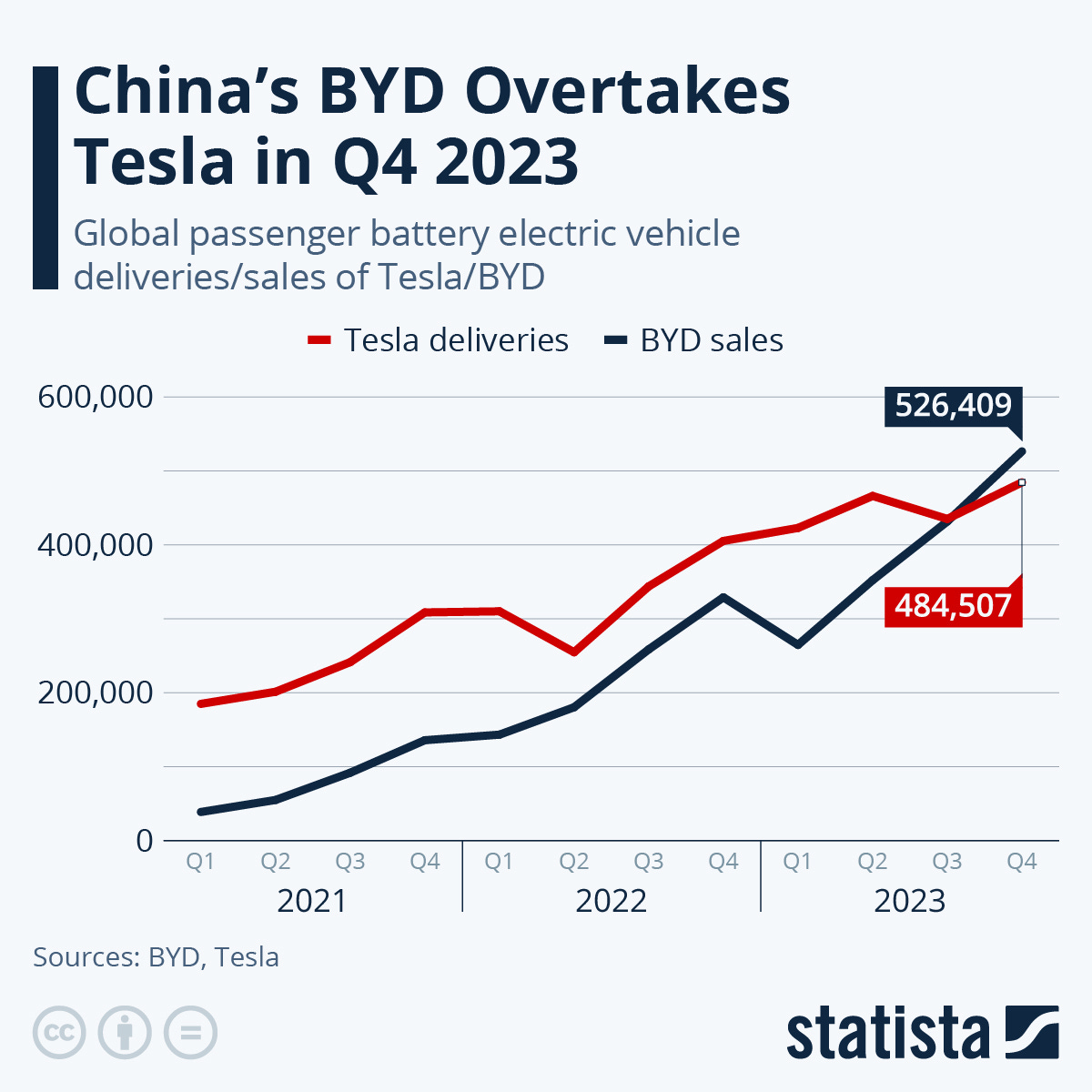

According to Chan, China's choreography of state-owned enterprises, local governments, and private firms has resulted in rapid scale and market dominance across industries from EV batteries to semiconductors. China's laser-focused industrial policies, backed by significant government investment, have propelled its rise in key technological sectors such as quantum computing, robotics, and AI, exemplified by breakthroughs like DeepSeek's open-source AI models or BYD’s ascendancy in electric car manufacturing.

In stark contrast to China's forward-looking investments in research, infrastructure, and education that support its growth trajectory, the United States risks strategic decline. To Chan, tariffs and other measures have weakened essential pillars of innovation, slashing public research funding, alienating global talent, and hindering companies' global market access. Despite giving credit to some of Trump’s intuitions, Chan notes that the president’s policy prescriptions risk accelerating the negative trends they intend to halt.

“The real consequences of cutting investment in science and research will take place decades from now.” – Kyle Chan

It is not hard to envision a future where America, sheltered by protectionist barriers, loses its competitive edge, its corporations forced into insular domestic markets with diminished earnings and reduced capacity for innovation. This risks bringing about not only economic stagnation but, on the larger stage, geopolitical irrelevance.

To Chan, if America doesn’t manage to pivot, its current trajectory will seal its fate as a waning global power. Avoiding this fate will not only take coordination, but imagination as well:

One thing that I would try to pitch to Americans… is to take industrial policy seriously, to do it in a careful and deliberative manner, [and] to think about the full range of policy tools that can be used.

Watch the full interview now.

Support Decouple

We rely on individual donations to bring you incisive analysis from top thinkers. If you enjoy our work, please consider making a pledge via our Substack or a tax-deductible donation via our fiscal sponsor.

Keywords

Involution capitalism, stock buyback capitalism, industrial policy, US-China competition, economic complexity, critical technologies, high-tech manufacturing, strategic rivalry, financialization, state capitalism