This week, we talk about Russian nuclear exports. Michael Seely, host of AtomicBlender, joins me to discuss the rise of Rosatom: Russia’s nuclear energy behemoth that now builds nearly half of the world’s new reactors. We trace its formation after the Soviet collapse, its grip on the nuclear fuel market, and its unmatched “turnkey” model for newcomer nations. Rosatom’s nuclear exports are more than just a commercial endeavour—they can reshape global influence for decades.

Watch now on YouTube.

We talk about

The creation of Rosatom in 2007 from fragmented Soviet nuclear enterprises

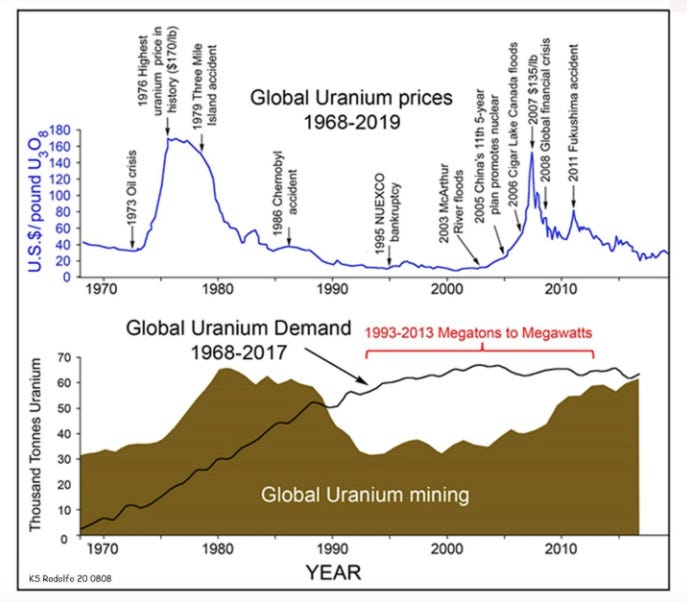

The “Megatons to Megawatts” program’s role in reshaping uranium markets

Rosatom’s vertically integrated “one-stop shop” for nuclear projects

How Russian financing and fuel services lock in long-term influence

Nuclear export analogies: buying a full car vs. just the engine

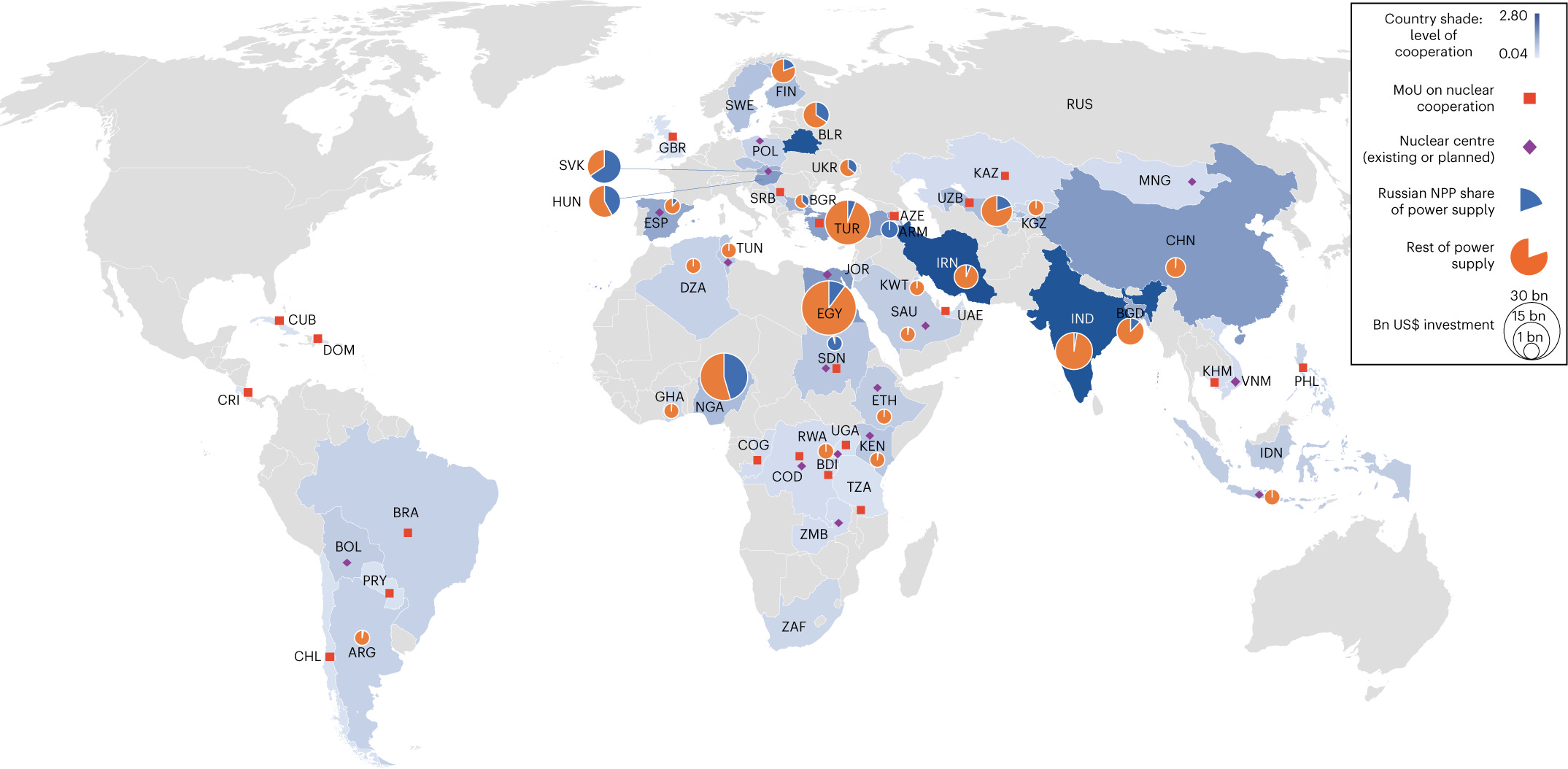

Strategic gains from nuclear exports—soft power, energy leverage, and “castles” abroad

Effects of sanctions and the resilience of Rosatom’s non-Western markets

Zaporizhzhia under Russian control and the limits of wartime nuclear operations

Russia’s advanced reactor and SMR programs, including fast reactors and Arctic deployments

Why Western nations and companies can’t currently match Rosatom’s capabilities

China’s growing potential as a Rosatom-level competitor

The political and economic realities shaping nuclear expansion in the West vs. East

Deeper Dive

Rosatom did not emerge overnight. It was forged from the scattered remains of Soviet nuclear industry—state-owned factories, design bureaus, and operating companies—pulled together under Vladimir Putin in 2007. This consolidation preserved skills and capacity that Western firms allowed to atrophy. Crucially, Russia never took a multi-decade pause in construction as the U.S. did. While Westinghouse shed staff and subcontracted core functions, Russia kept building reactors at home and abroad, sustaining a workforce capable of delivering entire plants from concrete pour to fuel delivery.

Part of Rosatom’s rise traces back to an unlikely source: the U.S.-brokered “Megatons to Megawatts” program. Throughout the 1990s and early 2000s, Russia downblended bomb-grade uranium from its warheads and sold it cheaply into U.S. reactors. What seemed like an American triumph flooded the market, drove down uranium prices, and gutted American mining and enrichment. For Russia, it built supply chains, export relationships, and credibility as a reliable nuclear fuel supplier. When the program wound down, Rosatom simply swapped in its own commercial product—keeping customers and market share.

Rosatom’s export model is straightforward, and devastating to its competition. Michael uses a car analogy: Western vendors will sell you the “engine” (the reactor island) but leave you to source turbines, control systems, construction crews, and financing on your own. Rosatom offers the whole car: reactor, turbine, grid hook-up, fuel, training, waste services, even financing—often at below-market rates backed by Russian state banks. For many newcomer nations, this is irresistible. The result is not just a power plant, but a 60+ year relationship that gives Russia an enduring presence in the host country.

“[Russia said] we’ll provide the technology. We’ll provide the construction. We’ll provide the operations. We’ll provide the fuel. We’ll provide the financing. We’ll help you set up the regulator. We’ll do absolutely everything you need to do to go from zero to full.” – Michael “AtomicBlender” Seely

Every Rosatom plant abroad is a geopolitical “castle,” as Michael puts it. Fuel designs are proprietary, regulators are often trained by Russian experts, and replacement parts flow through Russian-controlled channels. Switching suppliers can take a decade. Even NATO member Turkey has taken the deal, giving Rosatom majority ownership of its Akkuyu plant, and thus a legal foothold in its energy infrastructure. Sanctions have slowed projects in Europe, but in Asia, Africa, and the Middle East, Rosatom’s order book remains full.

Rosatom’s technological breadth further cements its lead. Beyond its standardized VVER reactors, it operates large fast reactors, builds floating SMRs for Arctic ports, and runs a fleet of nuclear-powered icebreakers. These are not paper designs; they’re in service today. Matching this capability in the West would take decades of investment, state backing, and industrial coordination on a scale that no Western government has yet attempted. China is closer, having built a vertically integrated program and begun courting export customers, but for now, Rosatom stands alone in delivering nuclear as a seamless, end-to-end package. The West can still win parts of the game—safety culture, licensing craft, component niches—but not by saying we have the “best design” and hoping the rest appears.

Videos referenced

Michael's video on Canada:

... on Russia:

... on Ukraine:

Support Decouple

That’s all for today. If you value this kind of nuclear power reporting, help keep it going. Consider pledging your support on Substack, or making a tax-deductible donation through our fiscal sponsor at: https://givebutter.com/decouple