This interview was recorded on September 24, 2025.

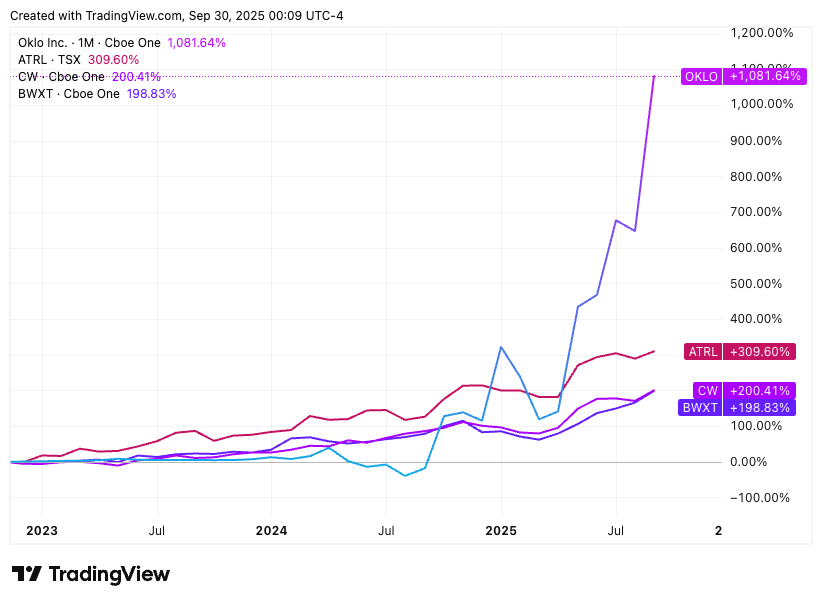

As I wrote on LinkedIn last week, nuclear has entered its meme stock moment. Oklo hit a peak market capitalization of $20.7 billion on September 22nd —more than established nuclear giants BWXT, Curtiss-Wright, and AtkinsRéalis—despite having zero revenue, no NRC design certification, and a rejected license application. In my conversation with returning guest Michael Seely, aka AtomicBlender, we examine this eyebrow-raising valuation built on glossy renderings. If Rosatom, with 70 years of R&D and thousands of specialized engineers, technicians and scientists, struggles to make sodium fast reactors commercially viable, how will a Silicon Valley startup accomplish it in two years? When this bubble bursts, the entire nuclear renaissance may pay the price.

Watch now on YouTube.

We talk about

Why Oklo’s market cap matches or exceeds nuclear giants with billions in actual revenue

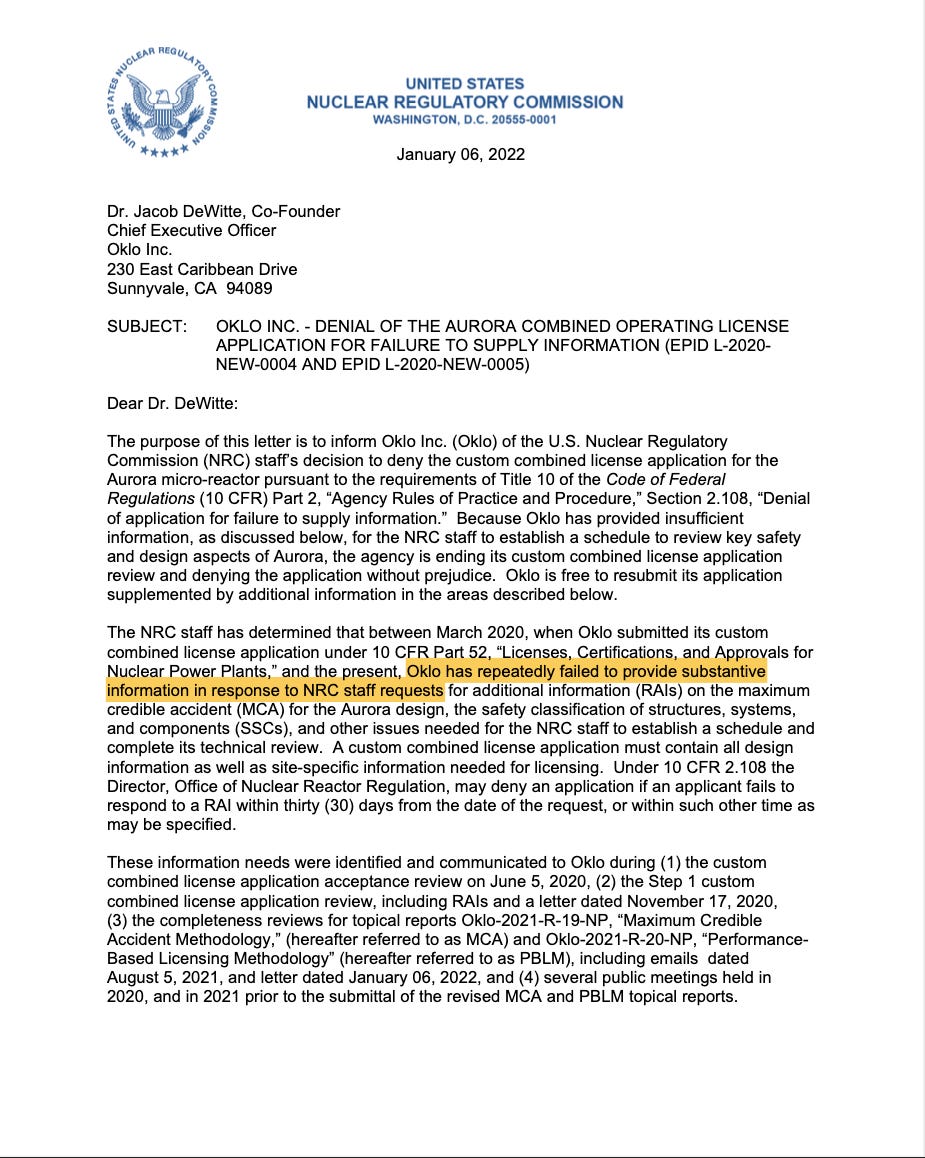

The rejected 2020 NRC application: missing basic safety details and accident analysis

Design alterations: from 1.5 MW to 75 MW in just a few years

What’s actually being built at Idaho National Lab (hint: it’s not a reactor)

Russia’s 70-year struggle to make sodium fast reactors commercially viable

A Theranos vibe? Star-studded boards masking technical immaturity

Why this bubble threatens the credibility of the entire nuclear industry

Deeper Dive

Last week, Oklo was valued at $20.7 billion—more than nuclear giants BWXT ($16B), Curtiss-Wright ($19B), and AtkinsRéalis ($12B). As of writing this, Oklo has come down to a still-massive market cap of around $17 billion. This is a sobering comparison. BWXT supplies nuclear reactors and components for the U.S. Navy with roughly $3 billion in revenue. Curtiss-Wright delivers aerospace and defense systems, also with approximately $3 billion in revenue. AtkinsRéalis services dozens of reactors worldwide with roughly $7 billion in revenue. Oklo? Zero revenue.

It has no NRC design certification, either. Oklo’s 2020 license application to the NRC for a 1.5MWe heat pipe-based sodium fast reactor was rejected in 2022. Since then, it has abandoned the heat pipes, pivoting to a 75 MWe version—fifty times larger than its original design. What Oklo does have is a star-studded board, including until recently Sam Altman of OpenAI and current Secretary of Energy Chris Wright. It also has a powerful narrative of turning nuclear waste to energy. This narrative has been valued higher than companies delivering actual products today.

Oklo’s rejected NRC application reveals the gap between Silicon Valley confidence and nuclear reality. My guest Michael Seely explains how the company proposed a novel “maximum credible accident” approach, trying to bound everything with a single worst-case scenario rather than analyzing the full spectrum of failures. The NRC found it “not repeatable and not fundamentally sound.” Oklo excluded entire sections, claiming the design was so safe that operator training, fitness for duty programs, and cybersecurity weren’t necessary or under NRC purview. Their technical specifications, normally 300 pages for an application, consisted of just two requirements. After two years of meetings, the NRC rejected the application for insufficient information and non-responsiveness.

What about the recent “groundbreaking” at Idaho National Labs? Oklo is bypassing normal NRC review by working under Department of Energy authority, but what’s actually being built? Seely clarifies it’s “initial groundworks” and “support structures”—not nuclear components. “It’s more of a ceremony than an actual start of construction,” he says. Pouring foundations isn’t remotely the same as licensing and installing a reactor vessel, not that Oklo claimed it was. What Oklo does claim is that it plans to deliver revenue by 2027. Seely and I struggle to see how fabricating metallic fuel, proving safety cases, and operating a sodium fast reactor in the U.S. for the first time since EBR-II closed in the 1990s is a two-year task.

Sodium fast reactors remain challenging even for nations with decades of experience. Russia’s BN-600 and BN-800 at Beloyarsk have had challenging operating histories, including 14 sodium fires. If Rosatom, a vertically integrated behemoth, struggles to make its sodium fast reactor technology commercially competitive its light water reactor fleet at 800 MWe, what hope does a sparsely staffed startup with 120 employees, many of them in communications, have at 75 MWe? Rosatom’s Afrikantov design bureau, which oversees its fast reactor program, employs roughly 4,000 staff, with 1,600 in engineering and 2,000 in research and materials testing. These are specialists with decades in sodium technology. When China built its fast reactor with Russian assistance, it took 20-22 years. Seely asks: If these two companies, with 50 years of experience behind them, 4,000 technical staff, and effectively unlimited funds take over a decade to build a single reactor, how is Oklo going to compete with that in two years?”

“Sodium is not like water. It’s not easy to understand, and it’s much more difficult to work with. And very few people have experience in dealing with it.” – Michael Seely, AtomicBlender

Investors are pricing Oklo as if licensing and technical challenges are already solved. But this is not the case. The company claims 14 gigawatts of non-binding power purchase agreements, an order of magnitude more than Russia’s entire operational fast reactor fleet, but these are memorandums with no money changing hands. Even basic due diligence shows this valuation is preposterous.

What goes up must come down, and when it does, the reputation of the nuclear industry will too. Not to mention, investors might have a meltdown.

Watch Michael’s excellent video on Oklo:

Support Decouple

If you find our work valuable, consider supporting Decouple by pledging on Substack or making a tax-deductible donation through our fiscal sponsor at Givebutter.

Note: This post was made with the help of modern AI.