By Chris Keefer | Decouple Media | November 2025

Introduction: A revealing case study

Every so often, a conversation unintentionally becomes a lens through which much larger structural realities come into focus. Speaking with Hadron Energy’s twenty-four-year-old founder, Samuel Gibson, had precisely that effect. Gibson is bright, enthusiastic, and surrounding himself with experienced colleagues.

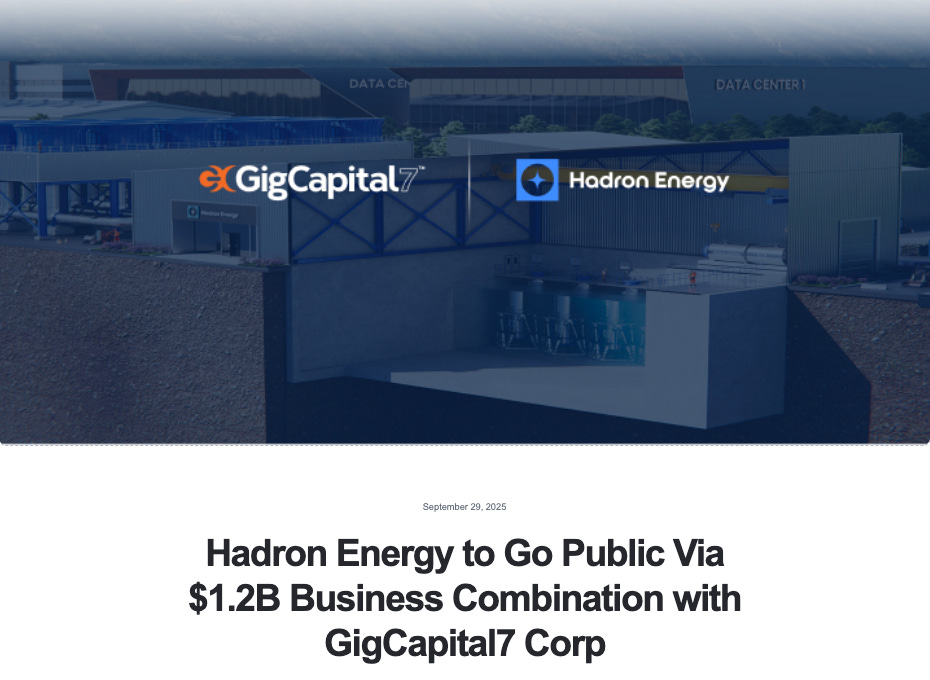

He has assembled a team with genuine industry pedigree, secured the attention of investors, and positioned his 10MWe integral pressurized water microreactor concept within one of the most hyped capital cycles in nuclear history, through a business combination with the GigCapital7 SPAC that values the company at roughly 1.2 billion dollars. His project is not unusual in its ambition or in the claims being made on its behalf. Its explanatory value lies precisely in how representative it is of the broader ecosystem of American nuclear startups.

Over the past five years in America in particular, a narrative has taken hold that nuclear energy is on the brink of a renaissance driven not by national industrial programs or established vendors but by venture-backed companies promising rapid iteration, factory fabrication, software-like scaling, and a decisive break from the mega project construction fiascoes of the past. These companies are staffed by earnest people. What they share, however, is an underlying set of assumptions about nuclear engineering, regulatory structure, and industrial capacity that struggles to hold up under scrutiny.

The resulting picture is not one of malice or deception, but of a profound mismatch between the material realities of nuclear technology and the cultural expectations of the American startup world. Hadron is a useful example because it sits squarely within this narrative, and because the conversation with its CEO highlighted the degree to which the United States is trying to compensate for a hollowed-out nuclear industrial base with a kind of entrepreneurial exceptionalism that cannot substitute for steel, concrete, or supply chain depth.

This episode and the essay it has inspired below, examines those structural mismatches through four interconnected themes: the persistence of fixed civil and regulatory costs in microreactor designs; the hard lessons embedded in the NuScale experience; the revealing contrast provided by Russia’s RITM-200 micro reactor program; and the seductive but misleading category error of associating microreactors with diesel generators despite the unique phenomena of radiation and resulting decay heat.

Taken together, they point toward a sobering conclusion: whatever breakthroughs lie ahead in nuclear energy, they are highly unlikely to emerge from narrative arbitrage or venture-driven optimism, but rather from institutions capable of rebuilding the industrial, regulatory, and cultural machinery that genuine nuclear deployment requires.

Microreactors and the non-linear scaling problem

One of the most persistent ideas in the microreactor community is that shrinking a reactor’s thermal power should proportionally shrink the cost and complexity of the supporting civil structures enabling factory mass production to not just break even but generate healthy profit margins.

This becomes a challenging proposition at small scales. A 10MWe microreactor running at 100% capacity factor on a generous power purchase agreement of $150/MWh generates roughly $13 million dollars per year or just $1500/hr.

Multiple unit sites will generate more income but the cost of capital on a 100’s of millions to billions of dollars project as well as the full time staffing needed for nuclear operations, and the nuclear quality assurance, security, fuel fabrication, insurance and decommissioning accruals and regulatory compliance that must be carried year after year start to bite. Once these inherent obligations are accounted for, the margins left over to service debt let alone generate profit is vanishingly small.

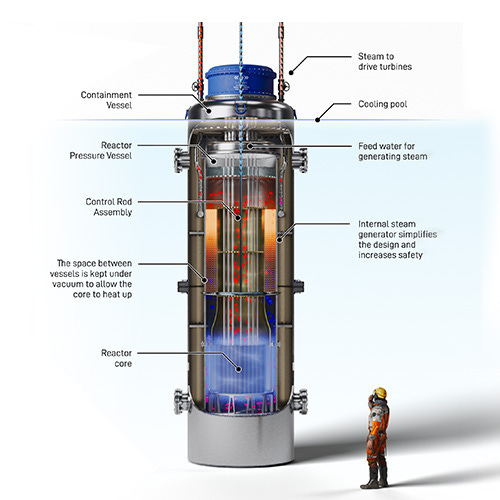

A revolutionary idea to make microreactors cheap is sometimes framed as “the nuclear industry should build airplanes, not airports.” This implies that the burdensome civil engineering associated with traditional 1 GW nuclear plants arises from unnecessary historical choices and large scale rather than from the physics of radiation, decay heat management and pressure boundaries.

While it is true that a smaller core and lower mass of irradiated Uranium does yield a smaller source term that can justify a compressed emergency planning zone, it is the exception that proves the rule in terms of the diseconomies of micro-scale and is perhaps outweighed by the cost of the total volume of fuel required for one hundred far less neutronically efficient 10MW cores to match the power output of a 1GW reactor.

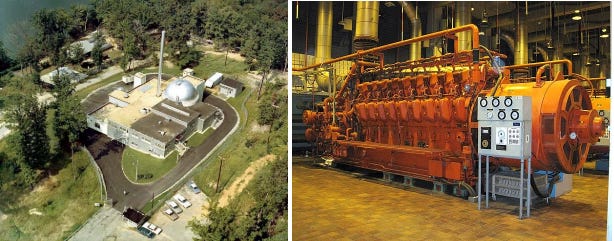

The difficulty is that while thermal power decreases, most of the nuclear specific burdens do not scale down linearly. For example biological shielding thickness decreases only modestly because fast neutron attenuation and regulatory dose limits dominate. The 200 kWt Chicago Pile 2 reactor, whose maximum theoretical power output could power 200 toasters, needed roughly five feet of concrete shielding. This puts it in the same ballpark as the several foot thick biological shields that surround gigawatt scale reactors like the AP1000 which is 16,000 times more powerful, capable of simultaneously powering a stunning 3.2 million toasters! yum yum.

Containment structures for tiny PWRs still require design pressure and temperature ratings in the same range as full scale PWRs because the reactor coolant system operates at comparable peak conditions.

Seismic Category I requirements are unchanged because the ground motion and qualification criteria do not depend on electrical rating.

Fuel fabrication, nuclear grade quality assurance, and the regulatory definition of design basis accidents do not shrink into obscurity simply because the reactor is small. The result is that many of the major cost drivers of nuclear engineering remain effectively scale independent.

The difficulty lies not in a lack of imagination, but in failing to grasp that microreactors are not miniature versions of large reactors, they are large civil and regulatory frameworks wrapped around tiny cores. The airplane-and-airport metaphor collapses under that reality. Nuclear’s airport cannot be wished away or even scale down anywhere near proportionately to the power output of tiny two seater cessna airplanes. It is a structural feature of the technology, not a historical legacy of unimaginative, antiquated engineers.

If you are a policy maker, utility or fund manager who reads this for work, support it like you would any other research product. If Decouple informs your decisions, help fund the next episode that saves you from a bad one.

NuScale as Cautionary Tale

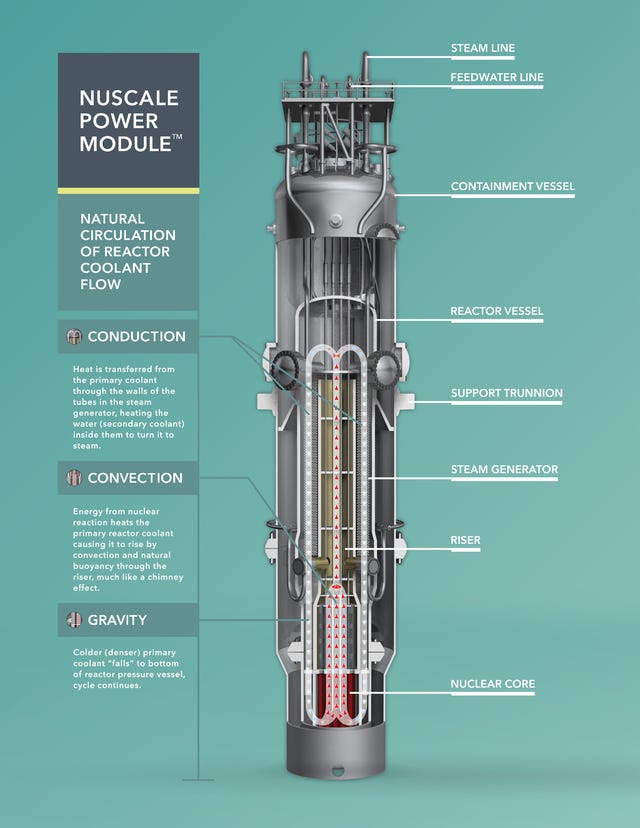

If there is a single case that should haunt microreactor advocates, it is the story of NuScale. Critics may question me describing NuScale as a microreactor but bare with me, as I explain below, it fulfills many of the same promises for example factory fabrication etc.

Unlike many of the companies populating today’s microreactor landscape, NuScale had real depth: university origins, prominent national laboratory involvement, partial ownership by a nuclear construction company, a seasoned engineering team, and eventually, hard-won NRC design certification.

Yet even with all those advantages, the economics collapsed as soon as NuScale’s FOAK facility encountered the realities of nuclear construction. By the time the Utah municipal consortium withdrew from the UAMPS Carbon Free Power Project (CFPP), the levelized cost had ballooned to over 20,000 USD per kilowatt, enough to make Votgle blush.

The microreactor community has tended to interpret this failure as a cautionary tale about “mid-sized” SMRs, arguing that a reactor in the 50–300 MWe class faces the worst of both worlds: too large to be factory produced, too small to capture economies of scale. Yet this reading ignores the fact that the NuScale power module is explicitly designed to be fully factory fabricated, assembled and tested before being shipped to site.

NuScale’s woes should be particularly prescient for Hadron given their approach of a factory produced integral PWR in a suppression pool is conceptually nearly identical to NuScale, with the disadvantage of being a long way from an NRC design certification and having a significantly lower power output.

Interestingly both NuScale and Hadron have scaled up their designs to improve their economics, from 55 to 77MWe in the case of NuScale and from 2 to 10MWe for Hadron.

The RITM-200 as an uncomfortable comparator

If NuScale embodies the structural limits of American SMR development, Russia’s 55 MWe RITM-200 integral pressurized water reactor line represents the counterexample that American entrepreneurs and microreactor financiers need to wrestle with.

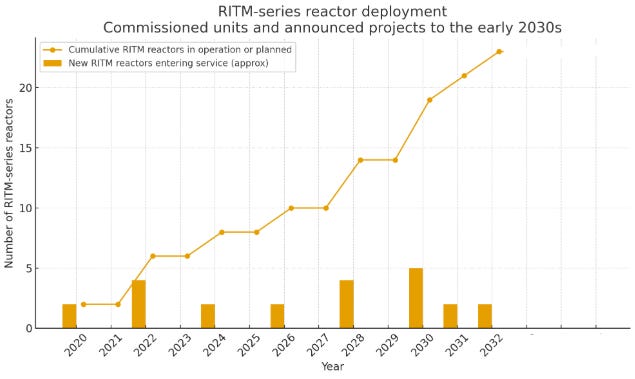

The RITM program is not a thought experiment or prototype. It is the only serially manufactured SMR family in the world, emerging from 3 prior generations of icebreaker reactors with eight units deployed and over 400 reactor-years of operation aboard icebreakers. More than a dozen additional RITM-200 reactors are currently in advanced planning, fabrication or assembly for floating power barges and land-based power plants.

The reason the RITM line exists at all is that Russia retained something the United States abandoned decades ago: a vertically integrated nuclear industry. The RITM reactor benefits from a dense ecosystem of designers, fabricators, metallurgists, machinists, test facilities, and state-backed institutions that, with the exception of a single decade hiatus due to the collapse of the Soviet Union, never ceased producing nuclear components. This is not a story of “disruption” but rather continuity, iteration and slow evolution which is the essential foundation of a credible Russian nuclear industry.

Why has Russia avoided atrophy in this sector and maintained a steady cadence of microreactor orders? The answer is a strong national use case involving its vast arctic which, unlike powering data centres in the U.S., absolutely requires the unique attributes of small scale nuclear power. Only this power source can effectively power the icebreaker program to open the vast northern sea route. Floating nuclear power plants and land based SMR program represent its most secure option to meet relatively small loads of small arctic communities and larger mines with N+1 contingency to unlock its mineral wealth. This small scale does not come cheap but the strategic rationale means that the state ensures that capital, expertise, and supply chains move in lockstep.

This aligns with my often stated axiom. “Nuclear is a need to have, not a nice to have technology” which is an obvious truism underlying the geographic distribution of nuclear energy in high and middle income jurisdictions around the world centred around the primacy of energy security.

This comparison is not flattering for American microreactor firms. Private startups can hire from a small pool of nuclear design, fabrication and construction talent but cannot conjure the equivalent of the OKBM Afrikantov design bureau’s 4,000 engineers, or piggy back off of AtomEnergoMash’s 20,000-person manufacturing base, by raising 300 million dollars in SPAC proceeds. Nor can they replicate the serial production discipline that emerges from decades of continuous marine nuclear propulsion work.

To put capital requirements in a broader context, the Tesla Model 3, a mass produced consumer electric vehicle, far simpler mechanically than an internal combustion vehicle and obviously with no radiological or decay heat hazards, required roughly one billion dollars in engineering before the first unit shipped. That scale of investment is a useful benchmark when evaluating whether a few hundred million dollars in SPAC capital can plausibly support the full development and deployment of a single first of a kind nuclear microreactor unit.

But perhaps the most humbling statistic is that despite Russia’s pressing national development objectives and its 450,000 strong vertically integrated state owned nuclear enterprise, it is only producing 2-3 RITM reactors per year. This stands in stark contrast to the ambitions of American startups that, with only thin capital, limited engineering depth, and a near non-existent supply chain, speak of producing tens or even hundreds of microreactor units over the next decade.

The American nuclear startup ecosystem operates in a vacuum left by the collapse of the U.S. nuclear industrial base, and it has not yet internalized that entrepreneurial enthusiasm, branding, and software metaphors cannot easily overcome that absence and the complexity of building nuclear power plants even when they are small.

The diesel generator comparison and its seductive simplicity

A common category error in thinking about microreactors is the comparison to diesel generators which after all, exist across four orders of magnitude, from small 5 kW household units to enormous marine diesels producing tens of megawatts. They are simple, robust, scalable, and capable of operating in remote environments with minimal infrastructure. Microreactors are the nuclear successor to this logic: small, modular, and easily deployed wherever steady power is required. Or are they?

The analogy is superficially attractive but collapses as soon as one examines the regulatory, engineering, and operational context. A diesel generator does not require a containment building, a safety-related cooling system to handle decay heat, a seismic Category I foundation, a biologic shield, spent fuel handling infrastructure, or a security perimeter. It does not require multiple round the clock shifts of licensed operators or a federal licensing process that unfolds over years.

The diesel generator is a straight forward machine that can be bolted down to a simple concrete pad. A microreactor is a system embedded within an entire institutional, legal, and infrastructural world. The fixed costs of that world dominate the total cost of ownership and cannot be made to disappear through clever nuclear engineering. For the above reasons small scale nuclear has always been expensive nuclear and those arguing that the future will be different are under a huge burden of proof.

Despite all of this microreactors may indeed be attractive substitutes for diesel fleets in environments so remote that every kilogram of freight must be flown, barged, or dragged across seasonal roads or through war zones. Even in such places, the romance of delivering a compact reactor module on a flatbed conceals the reality that civil works, site preparation, and integration are still substantial.

However this niche application also implies a relatively small customer base, which means limited unit demand and limited opportunity for learning curves or economies of multiples. Wright’s law only works when production volume climbs and if microreactors only make sense for markets where volume can never materialize this is a problem.

The deeper problem still is the back end. A microreactor deployed into a remote region develops a spent fuel obligation that cannot be forgotten in a shipping container. The irradiated fuel and later the core must eventually be removed, shielded, packaged, and transported by qualified personnel out through the same fragile logistics chain that justified nuclear power in the first place.

The cost, complexity and regulatory burden of extracting a highly radioactive core from an isolated mining site or Arctic outpost can dwarf the entire promise of cheap, long duration power.

These obligations do not scale down with thermal power, and they do not disappear because the reactor is petite. Eventually a microreactor that once looked like a logistical solution could become a long tail liability anchored in the least forgiving environments on Earth.

These harsh realities are perhaps why a seasoned firm like Westinghouse soberly retreated from the much-touted eVinci heat-pipe microreactor, quietly shelving it as a commercial offering despite the voluminous multibillion dollar micro-reactor bubble that we currently find ourselves in.

What Hadron inadvertently reveals about the U.S. nuclear ecosystem

Hadron Energy, with its young founder, seasoned advisors, and ambitious SPAC trajectory, embodies many of the hopes currently being projected onto the American nuclear startup sector. It is perhaps the clearest example yet of how the United States is trying to innovate its way around the absence of a functioning nuclear industrial base.

The notion that a startup can mobilize capital, licensing expertise, fabrication capacity, and a stable vendor ecosystem at a pace that outstrips state-directed industrial programs like the RITM-200 driven efforts to open Russia’s arctic is not supported by historical or contemporary evidence.

None of this is a critique of Hadron’s sincerity or effort. Rather, it is an indictment of the “post industrial” environment in which the company operates. A young founder in the USA may believe that nuclear success is a matter of personal drive, when the real bottlenecks are the decadal loss of nuclear megaproject management skills, construction productivity, ASME N stamped fabrication, NQA 1 supply chain and heavy forging availability. The broader narrative of nuclear as a startup frontier, is therefore less a reflection of genuine opportunity than of a country that has let core industrial capabilities atrophy and now tries to outsource state capacity to private ambition.

A more sensible path forward?

Perhaps the United States does not need a myriad of microreactor startups working in silos so much as it needs to build cohesive institutions capable of building proven, standardized reactors that benefit from well established economies of scale.

That vision has already begun to take shape in the form of the eighty billion dollar agreement between the United States government and Westinghouse to support fleet mode deployment of the AP1000. This approach concentrates capital, workforce development, supply chain renewal, and engineering effort around a single standardized platform. It allows the country to relearn serial production and to rebuild the heavy manufacturing ecosystem that once made American nuclear power a global force. Most importantly, it focuses national resources on a reactor class that already has reference plants, validated performance, and a deep technical base.

If nuclear is to flourish in America again, the sector should abandon the fantasy that reactors can be treated as fast moving consumer products. They cannot be built like electric vehicles because the physics, regulatory obligations and failure modes are different.

Hadron is not the problem. It is the mirror.

Reply and tell me what to dissect next: Paid subs come with the right to lobby for topics. If there is a reactor, policy, or deal you want taken apart with the same rigor of detail, say so. The best suggestions often turn into episodes and essays.

If you value having at least one outlet that treats nuclear as an engineering and industrial project, not as a vibes based asset class, please consider paying for it.

Financial independence is what guarantees editorial independence and that is what makes Decouple special.