By Chris Keefer | November 2025 | Decouple Media

A New Strategic Order

On October 28th, amid the choreography of President Trump’s visit to Tokyo, two vast and curiously intertwined announcements were made: an $80 billion strategic partnership between the U.S. government and Westinghouse Electric Company, and a $550 billion investment framework between the United States and Japan.

Both were trumpeted as milestones of industrial renewal. Both were, on inspection, acts of financial engineering with a shocking lack of detail. It is perhaps the nuclear reactor version of “We will build the wall and Mexico will pay for it” except this time with Japan footing the bill.

Behind the ceremony lies a new form of economic extraction. The United States, after decades of letting its nuclear construction capacity atrophy, is reaching for Japanese capital to underwrite its re-industrialization with perhaps the most difficult of industrial megaprojects. The chosen instrument is Westinghouse, a legacy American brand, ostensibly Canadian through Brookfield and Cameco ownership, but still culturally and materially American.

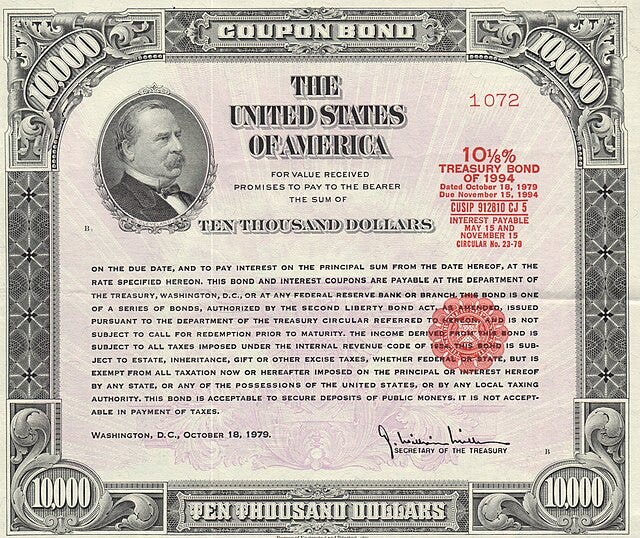

Japan, the world’s largest holder of U.S. debt, is being pressed to, in effect, roll its massive Treasury holdings into ultra-long “investment” instruments that can be taxed, transforming creditor status into a kind of economic tribute for continued U.S. protection.

Canada, meanwhile, is an awkward spectator: the nominal “owner” of Westinghouse through Brookfield and Cameco, yet with no real say in how the company will be used as the U.S. government negotiates the option of buying a future ownership stake.

The arrangement sketches a geopolitical triangle that is far from equal. The U.S. supplies the industrial policy, Japan the money, and Canada temporary symbolic ownership.

Westinghouse: From Industrial Core to Financialized Relic

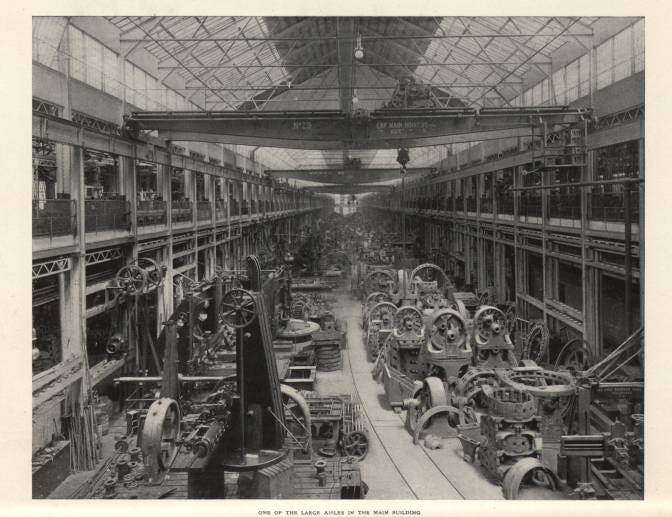

Westinghouse’s return to national prominence is not only a business story but a kind of cultural resurrection. Few companies trace American economic trends of the twentieth century so completely, from industrial might to financialization and a services/enetertainment centric economy.

Founded in 1886 by the iconic inventor-entrepreneur George Westinghouse, the company helped invent modern electrification. Decisively winning the “War of the Currents” against Thomas Edison’s DC electricity system, Westinghouse turbines, transformers, and AC distribution systems built the physical backbone of the grid.

Later on it partnered with Admiral Hyman Rickover as the developer of the world’s most widely deployed nuclear steam supply system, the Pressurized Water Reactor.

Westinghouse was, alongside Ford Motors and General Electric, part of the pantheon that equated national power with manufacturing prowess. By mid-century, reflecting the transformation of the U.S. economy towards a consumer society, it extended that industrial reach into the home, selling the radios, fridges and ranges that consumed the electricity its industrial hardware generated. The company was vertically integrated from generator to socket to end user appliances.

But the decisive transformation came when Westinghouse turned to financing consumption itself. The firm’s credit arm, created to help families buy refrigerators and radios, grew into a sprawling financial enterprise. By the 1980s, Westinghouse Credit was knee-deep in real-estate lending and commercial speculation. When that market collapsed, so did the company’s industrial foundation.

In the wreckage, the heavy-manufacturing stack was sold off piece by piece, transformers to ABB, turbines to Siemens and the remaining nuclear division was allowed to retain the Westinghouse name but was carved out and sold off to British Nuclear Fuels Limited. The remainder of the corporation morphed into a media conglomerate with CEO Michael H. Jordan deciding to acquire CBS for 5.4 billion. Ultimately Westinghouse, the proud titan of American industry ended up rebranded as Paramount Skydance. A bizarre metamorphosis from a product catalogue featuring turbines and transformers to hit TV shows like South Park and Yellowstone.

Westinghouse’s transformation mirrored the broader financialization of the U.S. economy, where industrial profits gave way to leveraged credit, services and entertainment. The nation that once measured power in megawatts began measuring it in capital gains and advertising minutes.

That transformation now haunts the American imagination. In a world where China dominates manufacturing, Westinghouse has become a vessel for nostalgia, a reminder of when the United States built its own machines. To “make Westinghouse great again” is to symbolically reverse four decades of de-industrial drift.

Rebuilding the Industrial Stack

The new U.S.–Westinghouse partnership sits precisely at that intersection of nostalgia and strategy. Its purpose is to rebuild the physical competencies the U.S. allowed to wither, forgings, nuclear-grade steel, and the specialized labor that once turned blueprints into nuclear power plants.

The plan’s architecture is as complex as it vague. Japanese capital may flow through the US treasury into the Department of Energy’s Loan Programs Office and through production and investment tax credits, backing the construction of up to eight AP1000 reactors on American soil. Westinghouse’s private owners will retain control until they have received roughly $17.5 billion in distributions, after which the U.S. government begins to capture 20 percent of additional profits. If valuations exceed about $30 billion, Washington can force an IPO and translate that share into an equity option worth up to one-sixth of the company.

In effect, the state acquires a leveraged stake in its chosen industrial champion, not by nationalization, but by financial participation. The U.S. government’s balance sheet becomes the scaffold for private re-industrialization.

Just as significant is what Westinghouse will not do. After the disastrous EPC contracts at Vogtle and V.C. Summer, it will leave full construction to firms such as Bechtel. Westinghouse will provide design, systems engineering, and fuel.. recurring revenue without schedule risk.

This marks a clear shift away from Reagan era free market fundamentalism towards state capitalism. The government identifies a strategic vulnerability like rare earths or a prestige industry like nuclear, absorbs financial risk through an ownership stake, and aligns public returns with private profit. In the vernacular of the moment it might pass for “MAGA industrial socialism.” Whatever it is it represents a belated recognition that markets alone will not rebuild complex strategic industries.

Japan’s Tribute and Tariff Diplomacy

If the United States is orchestrating the revival, Japan is paying for the orchestra.

Tokyo’s participation in the $550 billion U.S.–Japan investment framework transforms it from creditor to patron. Japan’s $1.2 trillion in U.S. Treasuries has long symbolized its financial dependence on Washington; now that capital is being re-channeled into direct American projects, including nuclear.

The mechanism is subtle but coercive. The administration’s 25 percent tariffs on Japanese exports can be reduced in proportion to Japan’s “investments” in U.S. industry: one percentage point of tariff relief for each major commitment. Japanese ministries have already listed “Westinghouse to build AP1000 and small modular reactors in the United States … investment up to $100 billion” as the top bullet of their new framework.

There are no clearly specified terms, no timetable, and no clarity, just the essential fact that Japanese capital will fund the rebuilding of American manufacturing capacity, under American direction.

This is looks a lot like tributary diplomacy: investment in exchange for protection and market access.

For Japan, economically mature but strategically exposed especially from an energy security perspective, the logic is grimly rational. With no interconnections to neighbors, no domestic fossil resources, and only weeks of LNG storage, Japan’s nuclear fleet is its only long-duration energy reserve.

One possible upside of this deal, staying within the U.S. nuclear ecosystem, even as a junior partner, might help it resuscitate some of its atrophied nuclear capabilities in the aftermath of the Fukushima induced closure of most of its nuclear fleet.

Canada: Ownership Without Control

Canada’s role in this triangle is the strangest. On paper, it “owns” Westinghouse through Brookfield and Cameco. In practice, that ownership is largely nominal. Through this deal U.S. government is treating Westinghouse as an American instrument, not a Canadian one.

Brookfield, though listed in Toronto, is a U.S.-headquartered private-equity conglomerate run from New York, Cameco is solidly based in the Canadian province of Saskatchewan. However both companies’ shareholder base is dominated by global institutional and retail investors. Only a minority of either firm’s capital is genuinely Canadian.

The company’s headquarters are in George Westinghouse’s home town of Pittsburgh; its fabrication and engineering centers are in the U.S. South. Its identity in American political culture is in the worlds of U.S. Energy Secretary Chris Wright, a “legacy U.S. firm.” It is now being brought home after decades of decline.

From a narrow financial perspective, Canadian investors are already benefiting: Brookfield and Cameco both saw share prices jump dramatically after the partnership announcement. But these are portfolio gains, not industrial policy.

The real strategic choice for Canada lies elsewhere: in Ontario’s plan for between 8 and 14 gigawatts of new nuclear capacity, roughly equal to the scale of the U.S. program being discussed. Ontario has approved studies for large new reactors at both the Bruce and Wesleyville sites, in addition to SMRs at Darlington.

The question is whether those plants will be built around Canada’s homegrown CANDU technology, a heavy-water, natural-uranium design whose IP is owned by the government of Canada, and anchors a domestic supply chain, or around imported light-water designs like Westinghouse’s AP1000.

CANDU’s advantages are structural: it avoids enriched fuel, uses modular pressure tubes instead of giant forged vessels, and relies on a largely Canadian ecosystem of suppliers. The benefits extend long after construction to the 60-90 years of fuel, IP development, major component replacement and engineering contracts all currently sourced within the Canadian industrial ecosystem.

During refurbishment, due to extreme supply chain localization the economic multiplier has been extraordinary: the Darlington project has returned about $1.40 of GDP for every dollar spent, according to the Canadian Chamber of Commerce.

By contrast, building AP1000s would tie decades of fuel, component, and service revenue to U.S. vendors. The upfront civil work would create local jobs, but the long-term industrial benefits would flow south.

So while Canada will see secondary gains, higher uranium demand, buoyant stock valuations, some potentially tariffed component manufacturing, it has little agency in the U.S.–Japan–Westinghouse triangle. Its real agency lies in choosing which reactor technology to back on the home front particularly in the context of Trump’s trade war.

An Unequal Atomic Triangle

The new atomic alliance is not an alliance of equals. The United States is reclaiming industrial agency; Japan is underwriting it; Canada is watching, half-participant and half-spectator.

The opacity of the numbers, the conditional $80 billion, the amorphous $550 billion, matters less than the direction of travel. Nuclear power has re-emerged as an instrument of statecraft. The U.S. is using it to reforge its industrial base, financed by allies whose security and economies are tied to its favor.

For Washington, it is a return to building.

For Tokyo, a reluctant act of patronage.

For Ottawa, a mirror held up to its own unresolved industrial identity.

If you made it this far, you care about how power really flows — electrical, financial, and geopolitical — and that’s what we do at Decouple Media.

Like and share this post if you think industrial policy deserves more than press releases and photo ops.